Decentralization is one of the most used and most misunderstood words in crypto. It’s often presented as a guarantee of freedom, fairness, and security. But in reality, decentralization is not a switch you turn on. It’s a system design choice, and it comes with trade-offs.

To understand why decentralization matters, you first need to understand how it actually works behind the scenes.

What Decentralization Means in Crypto

At its core, decentralization means no single entity controls the system.

In traditional finance:

- Banks hold your money

- Companies control databases

- Governments can freeze accounts

In decentralized crypto systems:

- Data is shared across thousands of computers

- Rules are enforced by code, not a central authority

- No single party can unilaterally change the system

But decentralization is not absolute. Most blockchains sit on a spectrum between centralized and decentralized.

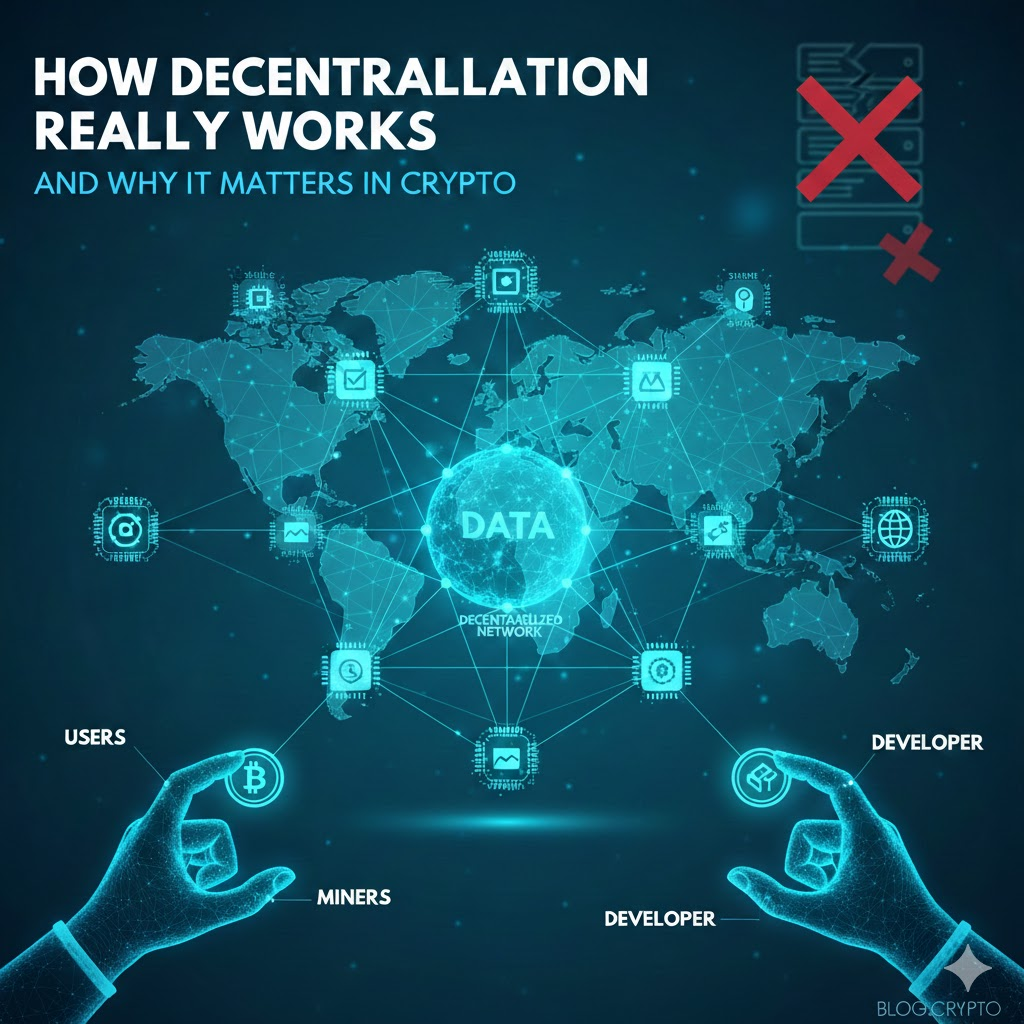

How Decentralization Actually Works

Decentralization in crypto depends on three main layers.

1. Network of Nodes

A blockchain runs on nodes computers that store and verify the blockchain’s data.

Instead of one central server:

- Thousands of nodes hold copies of the ledger

- Transactions must be validated by the network

- No single node can rewrite history on its own

If one node goes offline, the system keeps running. This redundancy is what makes decentralized networks resilient.

2. Consensus Mechanisms

Consensus is how decentralized networks agree on what’s true.

Since there’s no central authority, blockchains use algorithms like:

- Proof of Work

- Proof of Stake

These mechanisms:

- Decide which transactions are valid

- Prevent double spending

- Secure the network against attacks

Consensus replaces trust in institutions with trust in mathematics and economic incentives.

3. Open and Verifiable Code

Most decentralized crypto projects are open source.

That means:

- Anyone can inspect the code

- Anyone can run a node

- Anyone can verify transactions independently

This transparency limits hidden manipulation and builds trust without requiring blind faith.

Why Decentralization Matters

Decentralization isn’t just a technical choice it has real-world consequences.

Resistance to Censorship

In decentralized networks:

- No central authority can block transactions

- No single government can shut the system down

- Users maintain control over their funds

This matters most in regions with unstable banking systems or restrictive financial controls.

Reduced Single Points of Failure

Centralized systems fail when the center fails.

Decentralized systems:

- Spread risk across the network

- Continue operating even if parts break

- Are harder to attack or corrupt

This is why major blockchains keep running despite outages, bans, or political pressure.

Trust Without Intermediaries

Crypto decentralization removes the need to trust third parties.

Instead of trusting:

- Banks to safeguard funds

- Platforms to act fairly

- Institutions to remain solvent

Users rely on:

- Code

- Cryptographic verification

- Network consensus

This shift is subtle but powerful.

The Reality: Decentralization Has Limits

Not all crypto projects are truly decentralized.

Common centralization risks include:

- Few validators controlling the network

- Founders holding large token shares

- Governance controlled by insiders

- Infrastructure relying on centralized cloud providers

Even widely used platforms can become decentralized in theory but centralized in practice.

Decentralization must be continuously defended it’s not permanent.

Why Decentralization Still Matters Despite Trade-Offs

Decentralization is slower than centralized systems.

It’s harder to coordinate.

It’s less convenient at times.

But it offers something rare:

- Neutral systems

- Permissionless access

- Global participation without gatekeepers

That’s why decentralization remains the core value of crypto even as the industry evolves.

Real-World Example

Bitcoin is often cited as the most decentralized crypto network because:

- It has no central founder or company

- Thousands of independent nodes verify transactions

- Governance changes require broad consensus

This makes Bitcoin resistant to control but also slower to change.

Ethereum trades some decentralization for flexibility, enabling smart contracts and rapid innovation, while still maintaining a broad validator base.

Each design reflects different priorities.

Final Thoughts

Decentralization is not a slogan. It’s a design philosophy with real consequences.

When it works well, it creates systems that are:

- Hard to censor

- Hard to corrupt

- Open to anyone, anywhere

When it’s weakened, crypto risks becoming just another version of traditional finance only with new branding.

Understanding how decentralization really works helps you see past marketing and evaluate crypto projects for what they truly are.

In crypto, decentralization isn’t about perfection. It’s about who holds power and how easily that power can be abused.